IV. Public Debt

In 1997, Mexico will continue to deploy a pro-active debt management strategy that sets the following objectives:

- Lower the financing cost of the public sector,

- Extend and smooth the maturity profile of outstanding debt,

- Reduce vulnerability to market swings and changes in investors’ portfolio allocations.

On the external front, Mexico will continue to refinance non-peso denominated debt through:

- Opportunistic and responsible market access,

- Establishment of reliable pricing benchmarks,

- Diversification and expansion of investor base.

The net external indebtedness is limited by Congress to US$5 billion. Public sector issuance will be consistent with this ceiling and will be mainly concentrated in public agencies, like Nafin or Bancomext.

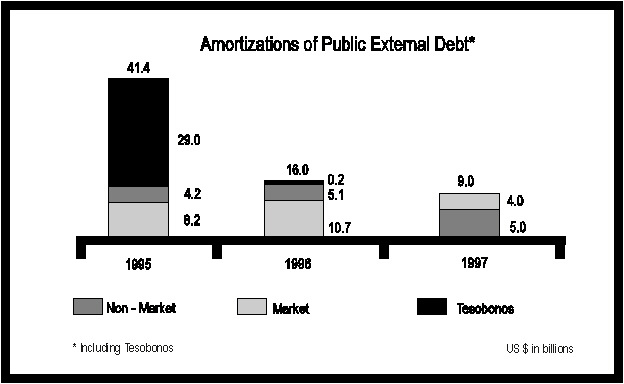

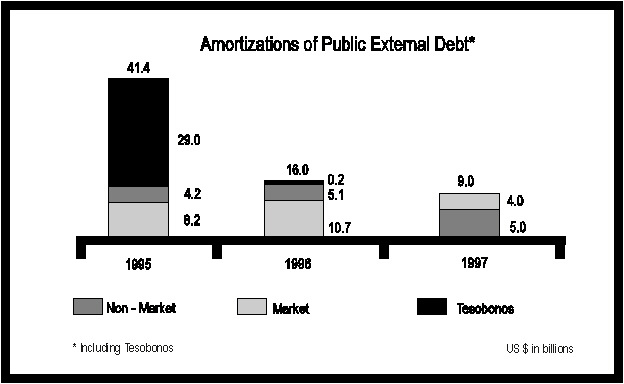

In 1997, Mexico will face lower external payments (See Appendix E).

On the domestic debt side, net debt will increase in line with the expected fiscal deficit, which will be entirely financed in the domestic market. In addition, the Federal Government will seek to extend the tenor of outstanding domestic debt by issuing longer-term securities.

Debtors Support Programs: Fiscal Cost

The total fiscal cost of the support programs for debtors and banks is estimated to reach 210.3 billion pesos in net present value, which is equivalent to 8.4% of the 1996 GDP.

It is important to recall that this cost will be generated during the lifespan of the programs, that is, in the course of the next 30 years.

Program | Total cost (mnp)NPV | % of 1996 GDP |

UDIs | 21,600 | 0.9 |

ADE | 4,300 | 0.2 |

FOBAPROA | 70,500 | 2.8 |

Capitalization schemes | 39,000 | 1.6 |

Toll roads | 26,100 | 1.0 |

Additional benefits of housing program | 27,200 | 1.1 |

FINAPE | 14,200 | 0.6 |

FOPYME | 7,400 | 0.3 |

Total | 210,300 | 8.4 |

See Appendix D.

As depicted in the table shown below, the Federal Government will have financed 42% of the total fiscal cost of the banking sector support programs in 3 years. The rest, 4.9% of GDP, will be generated as the benefits of the different programs materialize, during the next 30 years.

In the 1997 Budget, 0.35% of GDP is being allocated for interest payments of Fobaproa related financings.

Fiscal Cost Financing

NVP (millions of pesos) | % of 1996 GDP | ||

Total fiscal cost | 210,300 | 8.4 | |

ADE deposit | -19,840 | -0.8 | |

Banco de Mexico profits | -20,000 | -0.8 | |

World Bank/IDB loan | -15,100 | -0.6 | |

1997 Fobaproa financing* | -33,040 | -1.3 | |

Fiscal cost to finance | 122,300 | 4.9 |

*/ It is expected that Fobaproa will have to finance in the domestic market approximately 40 billion pesos.